Today, I will share one important tax provision that is often neglected and ignored because of not being aware about it and that is “taxability of gifts”.

Effective October 1, 2009, as per Section 56(2)(vii)/(viia))/(viib) of Income Tax Act, 1961, if an individual/ HUF receives a sum of money or property without consideration or with inadequate consideration, it is taxable to him/her as “Income from Other sources”.

Today let us understand this provision in detail:

Conditions for taxability of gift

A gift from one person to another is taxable only if following conditions are satisfied:

- It is received by individual or HUF (so gifts received by trusts, firms etc. are not within scope of this section)

- Gift is received on or after October 1, 2009.

- Gift is of the sum of money or property as defined in the section and falls in any of the 5 categories

- It does not fall in exempt category.

So only when all the above conditions are satisfied, the gift will be taxable in the hands of the recipient. Let us understand the finer meaning of conditions in more detail.

Which gifted asset is taxable?

According to Section 56, only if the gift is made of one/ more of the following does it attract taxability:

- Sum of money (cash/ cheque/ DD/ electronic transfer etc.)

- Immovable property

- Shares and securities

- Jewellery

- Bullion

- Archaeological collection

- Drawings

- Paintings

- Sculptures

- Work of art

Though the above is a very wide list, note that only the above-mentioned assets, if gifted, will be taxable. So, that means, if a rural agricultural land or a stock in trade of business is transferred, it will not be taxable.

When it will become taxable

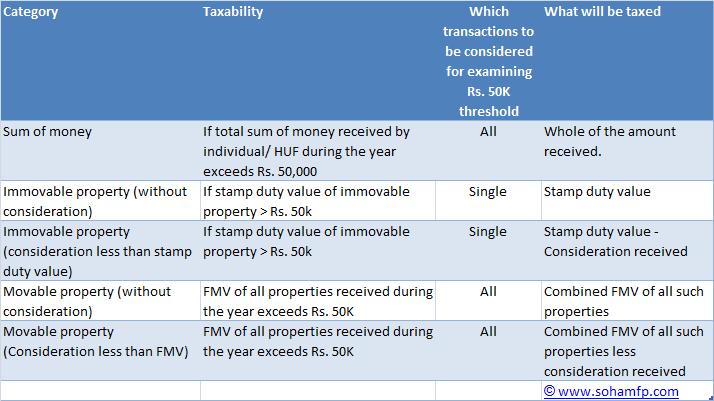

Refer the table below. It will be taxable only in the following situations:

Yes, this is the most important part and I guess you were waiting for it as well, so in the following cases, the gift received will be completely exempt from tax:

When gift will be exempt from tax

- From a relative (meaning of relative is given below)

- On occasion of marriage of individual

- Through inheritance or will

- In contemplation of death of the payer

- From a local authority

- From any fund, foundation, university or educational, hospital, medical institution

- Charitable institution registered under Income Tax Act

Relative – Meaning for the purpose of exemption

As we discussed, gifts received from relatives are exempt. Now, the question is: who will constitute a relative? Income Tax Act has defined “relative” for this purpose to be:

- Spouse of individual

- Brother or sister of individual

- Brother or sister of the spouse

- Brother or sister of either of parents

- Any lineal ascendant or descendant of individual

- Any lineal ascendant or descendant of spouse

- Spouse of persons referred in (b) to (f)

When gift is received from the above mentioned persons, it is exempt. Gift received from any other person will be taxable, subject to fulfilling the other conditions

Some examples

For better understanding, let us take some examples:

Example # 1:

Ramesh gets a gift from Suresh (his friend), of Rs. 25,000 on July 13, 2013 and Rs. 26,000 on August 21, 2013. What is the taxable amount for financial year 2013-14?

Answer: Full Rs. 51,000 is taxable in hands of Ramesh as “Income from Other sources

Reason: Because amount transferred is by friend so it is not in exempt category. Also, since it is a sum of money, so it has to be checked at an aggregate level for the year, and since the aggretage amount Rs. 51K is more than Rs. 50k, entire amount is taxable.

Example # 2:

Deep gets a gift from his grandfather of a flat whose stamp duty value was Rs. 18,00,000. How much amount is taxable?

Answer: NIL. Since the property is received from a “relative”, whatever be its amount, it is exempt.

Example # 3:

Ramesh gifts a fixed deposit to his wife Meena for Rs. 50,000. Meena also gets a painting from her friend whose fair market value was Rs. 10,00,000. What will be the tax implication?

Answer: Since the FD is gifted by her husband who falls in definition of relative, nothing is taxable owing to FD in hands of Meena. However, gift worth Rs. 10 lacs will be taxable as it is received from friend and is above Rs. 50K.

One more point: In view of clubbing provisions under Income Tax Act, if the transfer by Ramesh is without consideration, interest earned from that FD will be taxable in hands of Ramesh and not Meena.

Example # 4:

Sushant gave his friend Mahesh a cash loan of Rs. 1,00,000 for meeting a financial emergency. Would anything be taxable to Mahesh?

No, a “loan” does not qualify as a “gift” under Section 56 and will not be taxable in hands of Mahesh.

How can gift be made a tool for tax planning

Now, let us see how we can use legally use “gift” as a tool for tax planning.

Suppose you have a taxable income of Rs. 12 lacs and you have exhausted your Section 80C limit. One way to invest is in tax free avenues like tax free bonds etc., but suppose you decide to invest in FD, interest will be taxed to you @30%, resulting in very poor after tax returns to you.

One better option here is to gift the money to following relatives, if they are not having taxable income or are at say 10% tax bracket:

- Parents

- Parents in law

- Brother/sister

- Major child (son/daughter)

Note that here I have not considered spouse/ minor child, why? Because under clubbing provisions of income tax act, their income will anyway get clubbed in your return, so there will not be any benefit to you.

So, assuming there is a Rs. 1 lac FD that you gift to your father who does not have taxable income. Now, since father is a “relative” for purpose of the Act, interest of say Rs. 10K on that FD which would have otherwise got taxed in your return @30% amounting to Rs. 3K will become tax free. So, as a family, you save Rs. 3K in tax due to this arrangement.

Similarly, suppose you have an immovable property of Rs. 30 lacs in your name that earns Rs. 15K rent every month. Now, you can gift this property to your major son who presently is doing study. Since your child is a relative, the property value will not get taxable in his return as a gift. Also, Rs. 1.8 lac rental income will be completely tax free.

FAQ on gifts

Can a minor gift a property to someone?

NO. Minor is not competent to contract and hence cannot gift a property legally.

Have the donor/done need to be resident or they can be non-resident as well?

They can be resident as well as non-resident.

Are gifts received on occasions other than marriage exempt?

Only gifts received on marriage are exempt – that means, gift received on birthday etc. will not get covered in that exemption. Also, on marriage, only the gifts received by individual himself will be exempt. For e.g. on wedding of daughter, if gift is received by father, so it will be taxable in father’s return and will not be exempt.

- For immovable property, “stamp duty value” has to be considered. However, for movable property like jewellery, shares etc., fair market value has to be considered which has to calculated as per prescribed valuation rules (not detailing here for the sake of brevity)

Is a formal gift deed required?

Income Tax Act does not require a gift deed to be executed for such transactions. However, “gift” as a transaction is regulated by “Transfer of Property Act, 1882” which requires any transfer of interest in a property to be through a written instrument.

Also, as a best practice, it is advised to have a gift deed that clearly spells out the donor/done and details of gifted property along with preferably 2 witnesses, which becomes a record of the transaction. The gift deed can be then filed in your income tax file, and produced to income tax authorities, if required by them at any point.

So, final answer is YES – if you are planning to gift sum of money/property, execute a gift deed.

How to execute a gift deed?

Go to Google and search for gift deed formats, you will find one. It has to be executed on a stamp paper of Rs. 100/-. But in my view, a better and safer option (especially if amount is high) is to take help of a professional lawyer.

Is a registration required?

Yes, in case of transfer of immovable property, registration is mandatory by virtue of Section 123 of Transfer of Property Act, 1882. It will involve stamp duty and registration charges which vary from state to state.

Three words of caution on gifts

- Though gifting can legally save you tax, it is also important to consider the non-financial implications of your gift transactions. Understand that gift is irrevocable and thus, it’s totally based on trust.

Suppose you transfer one of your properties in the name of brother and sometime later the relationship turn sour, or you transfer in name of your major son, who later gets married and starts neglecting you, it’s better to avoid tax planning through this mode for little gain and keep the property in your control only. In such cases, a better option for estate planning will be to nominate the heirs through a will.

- A decision to gift in case of immovable property also needs to be seen from the perspective of registration and stamp duty charges, which is very high in certain states. Whatever gains by way of tax savings can be wiped out by the registration/stamp duty charges, making it a losing proposition for you.

- If you are transferring an amount in your friend’s account for financial assistance/emergency, ensure you sign a loan agreement stating the parties, terms and conditions and repayment conditions. Else, it may be construed as gift and if it is more than Rs. 50k, whole of the amount will be treated as income in the return of your friend.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com